Saving for retirement, for most people, is their largest financial challenge in life. While many people understand the importance of building up a retirement nest egg, and contribute a portion of their monthly salaries towards this goal – they do not always know if they will end up with enough money in retirement.

So how can you check if you are on track – and what should you do if you are not?

The following guidelines should help to make retirement saving feel like a manageable part of your savings, rather than a large monthly sacrifice:

Understand the process

The first step towards an effective retirement plan is to understand that it is a structured and long-term process.

A successful retirement process requires an investor to save enough (in excess of 15% of their salary) for long enough (at least 35 years), with an appropriate investment solution (determined by life-stage and inflation targeting) at a low cost (bearing in mind risk levels, administration and type of investments).

Finally, the investor needs to stick to the plan by preserving their funds, staying informed and only making changes when necessary.

Understand how much you will need

It’s one thing knowing that you need a plan. It’s another thing altogether knowing if that plan will get you to the lump-sum figure you will require to live comfortably in retirement.

In general, successful retirement savings will be enough to sustain 75% of your final salary adjusted for inflation annual for 20 years or more.

This may seem like a mouthful, but it is relatively easy to calculate – especially with the help of a financial adviser – and it is a crucial figure to know.

Check in as your career progresses

Once you have worked out how much you need to save towards retirement, it is not a simple case of saving each month until you reach that goal.

This is because many things will change over the course of your career that could affect your retirement savings – this includes salary changes, inflation rate changes and other external factors.

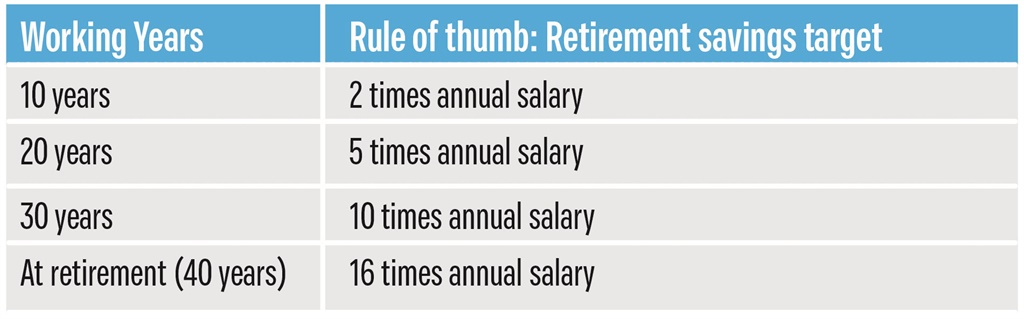

But there is a way to check if you are on track or if you need to make changes. The below table is a recommended guide to check your current retirement savings against your current salary.

If you realise along the way that you are falling short of these targets, you still have time to make adjustments to your savings plan to get back on track.

Consult with your financial planner to assess the shortfall and discuss the best way to address it. The options at your disposal will depend on your life-stage, risk profile and years left until retirement among other things.

Take advantage of tax savings

By utilising the tax benefits of retirement annuities (RAs) and tax-free investments, investors can noticeably enhance the amount saved for retirement – especially by reinvesting any tax rebates that they receive from their RAs.

A strategy that makes the most of tax efficiency is based on allocating a proportion of funds between a retirement saving vehicle and a unit trust or tax-free investment to create liquidity.